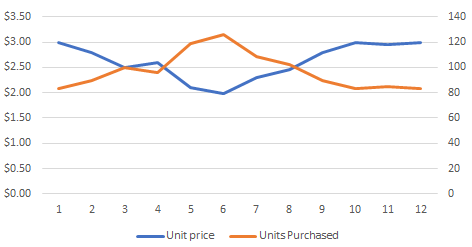

It’s easier to show how this works, than explain it. Here’s an example of investing $250 a month for 12 months into a hypothetical managed fund.

|

Month |

Unit price |

Units Purchased |

|

1 |

$3.00 |

83.33 |

|

2 |

$2.80 |

89.29 |

|

3 |

$2.50 |

100 |

|

4 |

$2.60 |

96.15 |

|

5 |

$2.10 |

119.05 |

|

6 |

$1.98 |

126.26 |

|

7 |

$2.30 |

108.7 |

|

8 |

$2.45 |

102.04 |

|

9 |

$2.80 |

89.29 |

|

10 |

$3.00 |

83.33 |

|

11 |

$2.95 |

84.75 |

|

12 |

$3.00 |

83.33 |

|

Total |

$2.57 |

1,165.52 |

At the end of the investment period, $3,000 has been added to the portfolio, but because more units were purchased when the market was down, the investor has bought 165 more units than they would have if they had invested everything on day 1. At the end of the time the value of the investment stands at $3,496.56 ($1,165.52 x $3). This is a 16.6% return – even though the unit price has only come back to its starting point.

Dollar cost averaging doesn’t always provide the best outcome or generate a positive return. In a rising market, there will often be periods when it doesn’t pay off. However, in turbulent times, when markets are flat or declining, dollar cost averaging into a diversified managed fund may well be the sensible way to unearth.

If you want to get started on a small dollar cost average plan, guess what, you already have, each month your employer contributes 10% of your earnings into an investment which you will contribute to over your whole working life, sometimes it will go in on a rising market, sometimes you will pick a GFC like event and get to buy in at heavily discounted price.

Recent Comments