You have put in the effort to start your own business and hopefully you are doing well from it.

But what happens if you cannot work due to injury or illness, will your business survive without you?

This is where business insurance comes into play, with a few options to look at too.

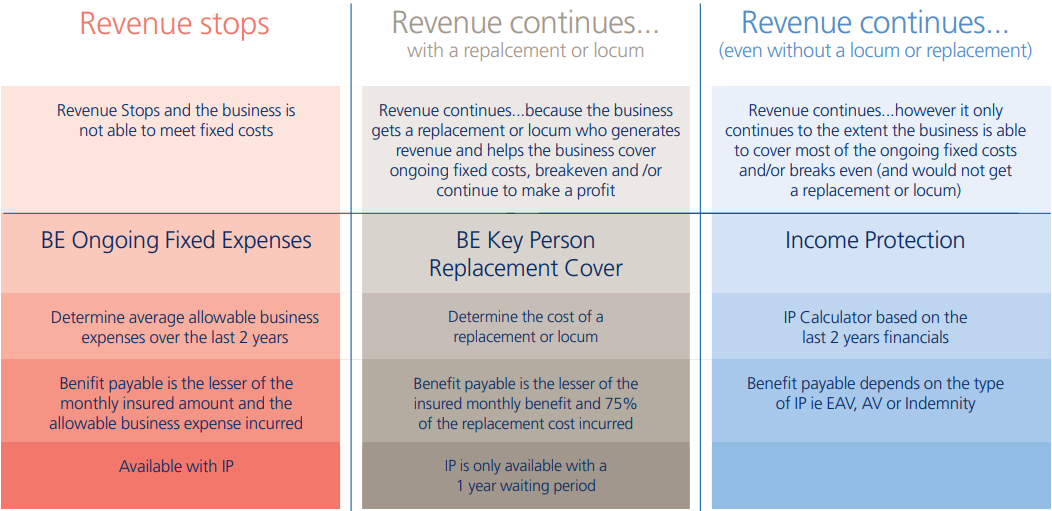

Business Expenses Insurance: Pays a monthly amount for up to 1 year while the insured is off work due to injury or illness. There are two things you can cover for with Business Expenses Insurance

Fixed Expenses Insurance

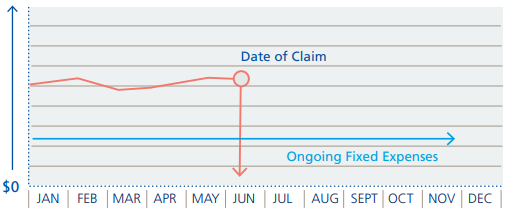

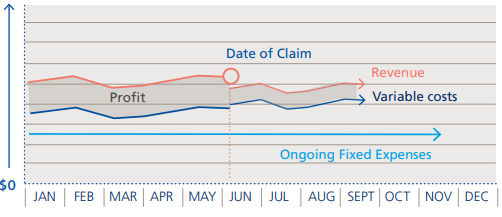

Traditionally, when a small business is reliant on the business owner to generate revenue, if and when the owner is not able to work because of sickness or injury the business can be at significant risk.

Without revenue to cover the on-going costs incurred by the business, the business can quickly find itself in a precarious and challenging situation. This is where Ongoing Fixed Expenses can provide a financial plan to cover these ongoing costs. It’s like a financial spare tyre for the business, to help it through a challenging period whilst the owner is unable to work.

Ongoing Fixed Expenses covers up to 100% of allowable business expenses which include:

• All the fixed infrastructure costs of the business that would continue if the life insured was not able to work; plus

• Capital/principal repayments on business debts related to identifiable business assets.

Business Expenses – Locum cover.

In some businesses, if the business owner is not able to work because of sickness or injury the business will need to hire a replacement or locum immediately.

The cost of a replacement can significantly impact the cash flow and overall profitability of the business . Key Person Replacement cover provides a short term solution to help fund the cost of a replacement or locum to ensure the business continues to operate and meet client service/delivery expectations.

To consider Key Person Replacement cover the life insured should be a business owner who is a key person in the business and would need to be replaced by the business if unable to work because of sickness or injury.

Next to consider is Key Person insurance

Key Person for Succession Planning

This cover is a business succession planning tool as it pays a lump sum on the insured death, total and permanent disability or specific medical event.

In simple terms, it provides:

• a terminating owner (or their estate) with the option to sell their interest in the business to the remaining owner(s)

• the funding mechanism for the remaining owner(s) to purchase it.

These benefits are achieved by implementing a formal agreement. This eliminates concerns by creating ready buyers and sellers for the business at a fair, pre-determined price. In establishing such arrangements, the participants define the circumstances that would trigger the sale and the agreed value. They agree on the legal documentation required and set up a funding plan.

Benefits

A buy/sell provision within the Business Succession Plan provides for business continuation with a minimum of disruption in the event one or more owners need to exit at short notice.

This plan:

• provides the business with every chance of survival

• ensures the terminating owner (or their estate) receives true value after tax

• allows for an orderly transition of ownership rather than forcing a fire sale

• helps retain key employees

• may reduce or eliminate the Capital Gains Tax (CGT) and stamp duty issues typically associated with mandatory agreements.

How it works

Even with a Business Succession Plan to ensure the transfer of a business interest upon death, all problems are not solved. The remaining owners need money to buy out the deceased’s family’s interest.

A number of funding mechanisms are available. The most successful is a combination of:

• Life insurance

• Trauma insurance

• Total and Permanent Disability (TPD) insurance.

All these can be covered by a buy/sell agreement.

Buy/sell agreements

There are two types of buy/sell agreements:

• ‘mandatory buy-outs’

• ‘put and call options’.

A mandatory buy/sell agreement does not provide the terminating owner (or their estate) nor the continuing owners with a choice as to whether they buy and sell. There is also the potential for stamp duty to be assessed on the full value of the business as at the date of the mandatory agreement.

Put and call options are arguably the most effective way of structuring an agreement to provide the same level of security as a mandatory agreement. A put and call option agreement is structured such that if one party to the agreement wishes it to proceed it will. Conversely, it will not proceed if all parties decide to set it aside.

Key person insurance covers the financial consequences caused if a key person dies, suffers a traumatic illness or is totally and permanently incapacitated.

Who is a key person?

A key person is someone who provides the ideas, drive, initiative and skills that generate the profits needed for the survival and growth of the business.

Key persons may include:

• managing directors

• computer programmers

• specialist engineers

• working directors

• sales managers.

The sudden loss of such a person has inevitable costs, not all of them obvious. As well as reduced sales or profits until a suitable replacement is found, there will be recruiting, specialist training and familiarisation expenses. There invariably is a negative impact on capital value, goodwill and credit rating of the business.

Key person insurance helps to overcome these unexpected setbacks.

Benefits

The benefits of key person insurance for a business are that it:

• provides funding to cover any outstanding debts and retain credit rating

• provides extra income in the event of the death or incapacity of a key person

• stabilises the business if a key person becomes incapacitated or dies.

Key person insurance for revenue purposes

Revenue purpose key person insurance is used to:

• cover the cost of replacing the income loss resulting from the death, total and permanent disablement or trauma of the key person

• compensate the equity owners in the business from loss of profits they would otherwise suffer due to the effect of the loss of the key person’s efforts.

Key person insurance for capital purposes

Capital purpose key person insurance is used to replace capital losses suffered by the business as the result of the death, total and permanent disablement or trauma of a key person. It may retire all or part of any debt owed by the business to:

• secured creditors (eg banks)

• equity participants

• creditors holding the benefit of the guarantor’s personal guarantee over a property as security.

Types of key person insurance

Key person insurance can include:

• Life insurance

• Trauma insurance

• Total and Permanent Disablement insurance.

Recent Comments