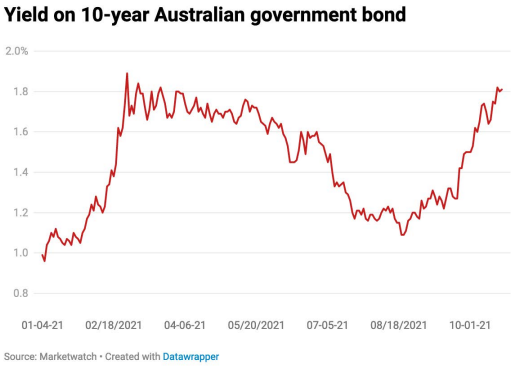

Bonds are back in the news. Yields on 10-year bonds locally and in the US have risen by 44% and 26% respectively since last month. The last time bond yields increased this quickly it sparked a sell-off in technology and other growth stocks in February and March this year.

Why have bond yields jumped again after months of moving sideways and should investors take notice?

What are bond yields?

At their most basic, bonds are loans. A bond is an interest-bearing IOU between an investor and the bond issuer. Governments and companies typically issue bonds as a way of raising money to finance spending.

Unlike a mortgage, the interest rate on bonds is usually fixed for the life of the loan. This makes bond prices sensitive to interest rate changes. A 10-year bond that earns a fixed 2% annually is unattractive when interest rates are 4%, but very attractive when interest rates are 0.1%.

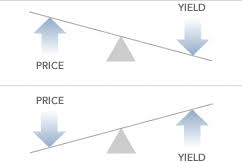

A bond’s yield is the return an investor would receive holding it to maturity. That yield is inversely related to price. Rising bond yields mean investors are selling bonds in the expectation that interest rates will increase. Falling bond yields mean investors are buying bonds expecting interest rates to fall. Yields and prices can also be impacted by investor’s expectations about inflation and economic growth.

Why investors take notice

Investors watch bond yields closely for two reasons:

1. They provide signals about the health of the economy

The global bond market is US$25 trillion bigger than the global equity market. Each day millions of transactions signal what participants—central banks, pension funds and large institutional investors etc —think about the future of interest rates, inflation and economic growth. Those signals aren’t perfect, but the bond market’s size means many investors use it to gauge the economy’s health.

The market for US government bonds is the largest and most important of them all, says Stephen Miller, a strategist at GSFM Investors.

“It reflects macroeconomic developments, arguably, quicker than any other market,” he says.

“It gets things wrong but it gives you the best guide to where market sentiment is at a particular point in time.”

2. They help investors decide how much to pay for stocks.

One way to determine a share’s value is to compare its expected return to the “risk-free rate”—the return an investor receives for taking little-to-no risk. The more money investors can earn for taking no risk, the less desirable risky investments such as stocks becomes.

The return on government bonds is often used as the “risk-free rate” because the likelihood of the US or Australian government defaulting on their bonds is comparatively low.

So, when the return on government bonds is low, stocks become comparatively more attractive. When government bond returns start to rise, more investors will opt for the lower risk option.

Why are bond yields rising?

Today, government bond yields are surging. Miller puts the recent jump down to three factors:

- The expectation the US Federal Reserve will start to reduce its billions in bond purchases

from next month. - Rising inflation – The Fed’s own forecast for core inflation in 2021 has risen from 2.2% to

3.7% since January. - The possibility that interest rates could increase sooner than expected.

Each affect bond yields differently. The Fed has been buying US$80 billion in government bonds each month. The tapering of its bond-buying program would take a major buyer out of the market, lowering prices and increasing yields. Meanwhile, higher inflation erodes a bond’s fixed interest rate, so investors sell bonds and yields rise. Finally, higher interest rates would make today’s bonds less valuable, again lowering prices and pushing up yields.

“I would be anticipating that between now and year end we’ll see a new high for the US 10-year bond yield,” says Miller.

“I won’t be surprised if we exceed the March high point this year.”

Mixed impact for equity investors

In the short term, higher bond yields could make some stocks less attractive by increasing the risk-free rate used in financial models. Miller thinks that while rising yields increase the risk of a market correction, the more likely outcome is a slowdown in returns.

“Rising yields will be more of a headwind than a swinging blow,” he says.

“Investors may need to get used to flat to low single digit returns for 2022 versus the growth we’ve seen since post-pandemic.”

Longer term, higher yields are a mixed bag for investors. They translate into higher borrowing costs, cutting into company profits. On the other hand, higher yields might bump up deposit account rates and mean better returns for income investors holding bonds and cash.

“Certainly investors seeking income would welcome higher yields eventually,” says Miller

Article republished from Morningstar, article written by Lewis Jackson 25 October 2021.

Recent Comments