Outlook

Both bonds and equities have suffered further losses as interest rates have continued to climb, though we had a short rally when the RBA only moved 25 points with markets breathing a sigh of relief that the aggressive front loading on interest rates could be behind us.

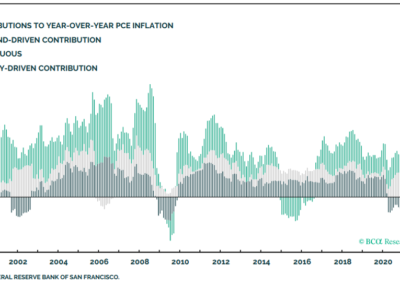

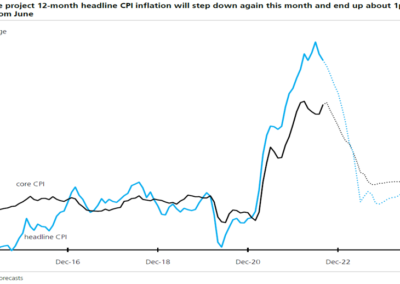

Central banks in a wide range of countries (expect Japan) have been tightening monetary policy to address inflation which has been sitting way about target levels and looking to possibly get a bit higher before starting to normalise.

It is still widely expected to have a downturn in 2023 with increased interest rates, as well as the uncertainty coming out of the Ukraine/Russia war and the constant lockdowns in China as they try to curb disease/covid.

Australia will suffer a slow down aswell, but we might get the avoid having to use the word “recession” if unemployment sticks at around 4% and exports keeps our GDP afloat. (With our dollar so low (62cents at time of writing), it makes our “expensive” natural resources cheap).

Bond Market

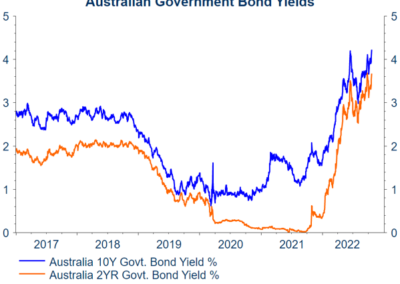

The 90-day bank bill rate is now 2.9% which is great for anyone using the First Home Super Saver Scheme which is up 2.8% for the year, the 10 year Commonwealth bond is now at 3.9%, up 2.25% for the year which has led to the Bond Market (A&P Australia Aggregate Bond Index) falling around 10% for the year.

The Cashrate is sitting at 2.6% up 2.5% for the year and the market is split whether it will be a 0.25 or 0.50 in the November meeting. Given the rate rises are still filtering through peoples mortgages, I am betting that it will be a 0.25 in November as banks play catch up raising everyone’s rates. (I know personally it is about 1.5 months between RBA rise and my Minimum Repayments actually going up).

With the Aussie dollar at a low as people move to US currency for it’s Stability there is little direction for the Aussie dollar to move but up from it’s current 62 cent, with markets pitting that we could be back to 70cents by mid next year. (this means it could be ideal to tilt international exposure to “hedged”)

Property

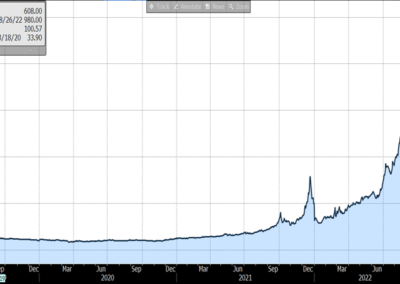

A-REITs continue to take a bashing as rates rise with the ASX200 A-REIT index down 28% for the year as house prices pull back off the back of tighter lending, and reduced borrowing power. Australia continues to fair better than our overseas counterparts with the US down 31.2% and the UK at 46% down.

The Australian market has continued to fall and may continue to do so with 90% of the market believing interest rates will continue to rise. The biggest impact looks to be shopping centers and office space, however retirement villages will continue to perform and we could see a strong return for tourism while we have a depressed dollar, giving tourist spots a much needed boost.

Australian Equities

As with last months (and the month before) banks are holding up well, and IT has caused most of the slump in the ASX200, the miners and metals index is currently sitting 4.7% down.

Businesses are looking optimistic with trading back at pre-covid levels, unemployment sitting at 3.5% and “consumer stress” being below average. (though cost of living stress is at it’s highest point since 2018)

The NAB consumer stress survey looks like our strong point will start to unwind in 2023 as consumers face mounting pressures from the increases in energy, mortgage repayments and food. Economic growth is pitted at 1% next year, down from our current 3.4%, with most of the decline from reduced consumer spending on goods.

International Equities

The MSCI world index is down 23.9% in US dollar terms, but thanks to our falling Aussie dollar (in unhedged AUD terms) the market has fallen 12.7% for us.

Current earning seasons is looking good for our overseas counterparts, and the oil and gas industry have been receiving a leg up with current energy prices, the FTSE Global oil and gas index is up 24%, and oil and equipment services industries are up 8.8% for the year.

The J.P Morgan Global Composite Index however has showed that business activity has slowed the last two months (August, September) and the IMF stating they believe the that “more than a third of the global economy will contract this year or next, while the three largest economies – the United States, the European Union and China- will continue to stall.”

Fund managers are also bleak in their forecasts with most expecting the market will continue to lose value till the end of the year, and with most stating that though we might not get a recession next year it will certainly feel like it.

This article has been reproduced and paraphrased from Morningstar Research Oct 22, 2022, Economic Update: Australia October 2022.

Recent Comments