The Superannuation Co-contribution Scheme started in 2003/04 to encourage us to make personal contributions to superannuation. It was targeted at low to middle income earners and has been improved progressively since then.

In 2018-19, more than 329,000 Australians claimed over $104 million in co-contributions. A lot of people are taking advantage of this opportunity.

The Thresholds

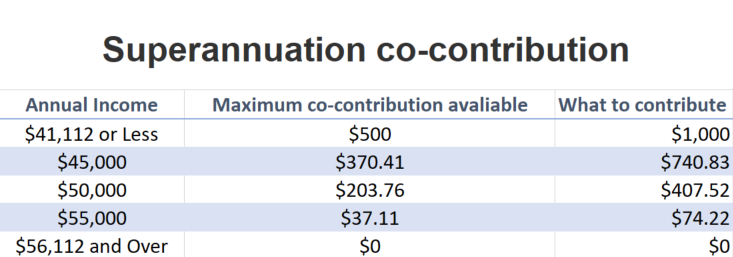

In the 2021-22 year, if you earn an income of $41,112 you can qualify for the maximum co-contribution. (Income = assessable income plus reportable fringe benefits.) The co-contribution reduces by 3.333c in the dollar for each dollar of income over $41,112 and cuts out when your income reaches $56,111.

To be eligible to receive the co-contribution you need to have a total superannuation balance of less than $1.7 million and have not exceeded your non-concessional contributions cap for that financial year.

Outlining the benefit available of the Government Co-contribution scheme and the contribution required to get the benefit.

If you are self-employed

The co-contribution is also available to self-employed Australians who earn at least 10% of their total income from employment or running a business. (Income = assessable income plus reportable fringe benefits less business income deductions.)

You must make a personal contribution without claiming a tax deduction for it. The Tax Office will work out the co-contribution amount from information on your tax return and details of contributions provided by your super fund.

A gift that will last a lifetime

Here’s a chance to give your children a unique gift.

As soon as they start work they could qualify for the co-contribution. But with retirement a long way off and other priorities (like having a good time) they are unlikely to want to part with $1,000 to pay into superannuation.

But what if you contributed it for them?

Assuming your child is 20 years old and earns less than $41,112, the government would match your contribution with $500. If you repeated this gift for five years and their super earned 7.5% they would have an extra $8,700 in savings. The power of compound interest means that by the time they reach age 60, they would have an extra $109,000 in superannuation!

Recent Comments