Update on Changes

Superannuation

From July 1 2021, we are seeing an increase to the Contribution caps, with Concessional Contributions going from $25,000 to $27,500, this greatly improves the scope for salary sacrifice and TTR strategies, this coupled with the Concessional Contribution Catch up we will see a great ability to reduce tax liability through contributing to super.

We are also seeing Non-Concessional Contributions increase from $100,000 to $110,000, however it is important to not that if you triggered the bring forward rule this (Fin) year you cap will be the 3x$100,000, so $300,000, not $320,000. So if you are looking at doing a lumpsum contribution into Super it might be worth waiting till 1 July so your limit is increased.

Next off we have the increase to the Transfer Balance cap, this is the amount of money that can move from super into the Tax Free Pension Phase (account based pension ABP). The TBC will increase to$1.7Million from it’s current $1.6million on the 1st of July, however this only affects new pension holders, as if you had already started a pension with $1.6 your limit has been reached and does not increase. So if you are on the verge of retirement, it might be worth holding off until July to retire so you can have an additional $100,000 in your tax free pension.

Taxation

Extending the Low and Middle Income Tax Offset (LMITO)

The LMITO was due to end on 30 June 2021 but will now be retained for one more year in 2021-22. It’s worth up to $1,080

for individuals or $2,160 for couples.

– The benefit for those earning up to $37,000 is $255.

– Between $37,000 and $48,000, the offset increases at the rate of 7.5 cents per $1 above $37,000 to a maximum of $1,080.

– Those earning between $48,000 and $90,000 are eligible for the maximum LMITO benefit of $1,080.

– For income above $90,000, the offset phases out at a rate of 3 cents per $1 and is not available when taxable income exceeds $126,000.

Increasing Medicare levy low-income thresholds

Proposed effective date: From 2020-21 financial year

Thresholds will increase from 1 July 2020 so low-income taxpayers will generally continue to be exempt from paying the Medicare levy.

The threshold for:

– singles will increase from $22,801 to $23,226

– families will increase from $38,474 to $39,167

– single seniors and pensioners will increase from $36,056 to $36,705

– families (seniors and pensioners) will increase from $50,191 to $51,094.

For each dependent child or student, the family thresholds increase by a further $3,597.

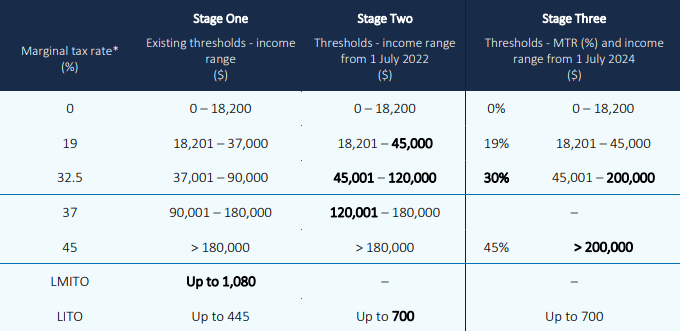

Below is the changes to the tax rates, with the biggest changes being the earning thresholds for the 19% and 32.5% tax brackets, additionally the LMITO has been extended into the next fin year (as discussed above) but is not shown in the table.

Recent Comments