A rally in both equity and bonds in July and the first half of August did not last, and prices resumed their slide in the second half of August and into September. With the exceptions of cash and infrastructure, most asset classes are now showing hefty losses for the year. The prime reason has been the likelihood that monetary policy will tighten more than previously expected, as inflation in a range of countries has proved to be more troublesome to corral than central banks thought.

Australian Cash & Fixed Interest

The RBA 90 day bank bill rate is up around 3.6% a huge leap from the 0.1% it was only 6 months ago. Bond yields are off their peak but a rising slowly again with the ten year up to around 3.85%. The Aussie dollar is around 2.3% up for the year and doing alot better than most currencies against the US but we are still sitting at 64.7cents (which i guess is great for exports).

The RBA however is still targeting that high inflation with their projections of a trimmed mean inflation of 6% (actual inflation is currently 6.8%) which would mean they will possibly add another 1.3% to the cash rate by mid next year unless consumer spending starts to fall down.

It is probably worth noting that some countries are still struggling with Japan still having their bond yields in negative territory for 1s and 3s, and we just saw a bit of an issue in the UK with Kwasi Kwarteng wanting to cut corporate tax rates to 15% to boost the economy while the Bank of England (BoE) was planning on starting Quantitative Tightening (QT). This lead to the Sterling crashing and bonds going volatile and the BoE had to do a reverse and starting buy 30 year Gilts to help out.

Not to mention the US had inflation at 9.1% in June which has at least settled to 8.3%, but will possibly be pushed up again as they are getting alot of wage pressure due to historic low unemployment.

Australian Equities

We have had a bit of a wash off since the rebound in July and August, and the trend continues with the IT sector still down the most YTD. Businesses have been having a good reporting season and the economy is still tracking up (0.9% for June qtr, 3.6%YoY), alot of this would be continued pent up demand spending for goods, and service spending returning to normal. (just cause you missed a years worth of haircuts doesn’t mean your going to get 4 haircuts in a row, but that saving could buy you a new smart TV).

Businesses are starting to brace for tighter conditions as PMI numbers are falling back to neutral at the 50 point mark, and consumer sentiment is at an all time low (however they say this, but they keep spending money).

The ASX200 is trading on a P/E of 12.8 which means we could start to see the Aussie market recover from as early as Christmas and most economists saying Australia will possibly avoid a recession though the multiple we are trading at suggests a soft recession is priced in. (think mining bust opposed to GFC).

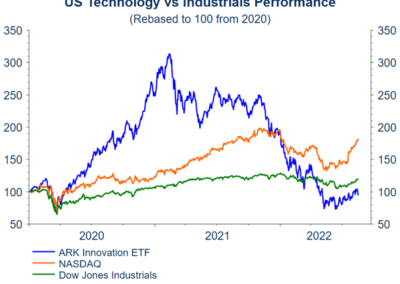

Continued high cash rates are going to see the tech sector struggle to get the growth figures they were running at in our lower for longer, with the current environment favouring low debt, high revenue companies, so we could see a strong return to consumer staples if they can keep their costs under control.

International Equities

The MSCI World Index is down 19% YTD, notably with Japan at -22.3% and Euro at -23.4%. So in that regard we have been fortunate to be only down 12.6% for the year and part of that was due to a fall in our dollar against the greenback helping our exports. The Global tech sector is still sitting 28% down for the year and the technology hardware side is down 24.8%.

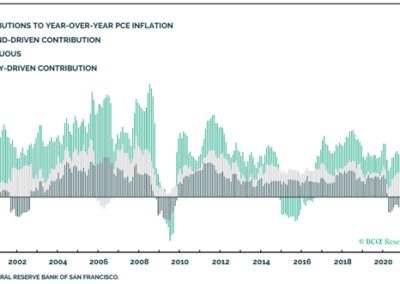

Given we won’t see the full impact of rising rates till early 2023 we could see a further slowdown in the global economy as business contend with lower sales volumes. On the flip side though we are starting to see the supply-driven inflation start to cool off with fuel starting to drop and futures looking favourable, used car prices are falling of their peak and from a freight standpoint things are looking great there too, with ships waiting at port 80% off it’s high at the end of 2021 and the world container benchmark and manufacturing supplier delivery times both starting to come off their peaks.

Recent Comments