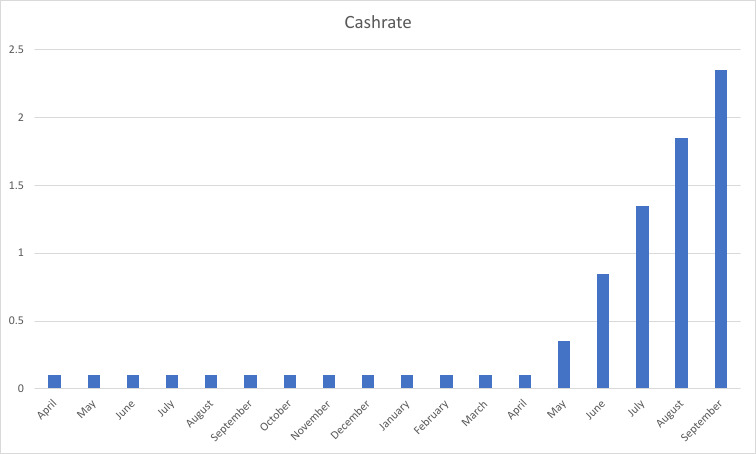

As we all know, interest rates are growing at an alarming rate.

We haven’t seen an increase this quickly since 1994, with the Reserve traditionally making a move, waiting, then moving again.

The banks will often sell you a mortgage that has an offset account under the guise that it will save you money in the long run as you have all your wealth transact out of the offset account reducing the interest charge on your mortgage.

They might even illustrate how you will pay off your loan a few years sooner by just having $10,000 set in the account.

However, what they won’t be doing, is showing you the difference between the basic homeloan vs the one with an offset account.

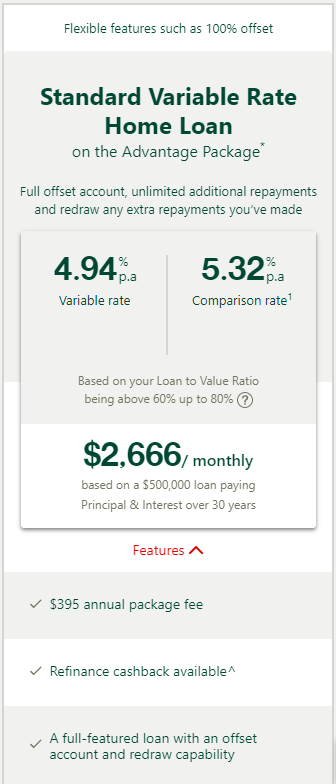

In the example below we are using St George which has a basic variable and the “advantage” variable type loan accounts.

From the outset, the “advantage” loan package is at a disadvantage, having to pay an annual fee of $395 and the interest rate is a whopping 1.25% more than the basic variable. (please note that small the interest rate gap, would mean that performance between the two accounts would be closer, and therefore their might be a cross over when the offset account is of better value).

First of all, we need to work out how much we need in our offset account to cover the annual fee. For this I am just using V=395*4.94%^-1 which gave me just under $8,000. It is important to note that interest is calculated daily though, so I should have used the PV formula.

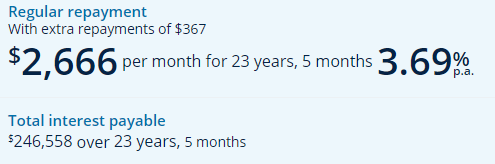

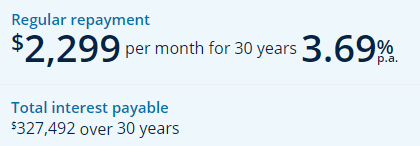

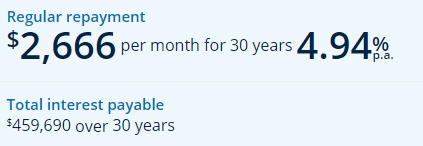

Okay, so we have the annual fee covered, and having $8k in an offset account isn’t unreasonable, next step is to work out the difference in % interest payable on our theoretical $500,000 mortgage. Again, keeping things simple we are just looking at the difference in required payments between the two loans, as the only difference will be the interest payable over the life of the loan, so $2,299p/m vs $2,666p/m means we need $367p/m or $4,404 a year.

Again, using the same formula as above we need another $89,150 in our offset account to do this.

As I said, I am just using basic formulas here, so if you did manage to have that much in your account you would actually end up saving quite a bit, and infact edge infront of the basic loan.

You can see from the above screen shots that the basic variable has you paying $327,492 in interest over the life of the loan, much less than the loan with offset which has you paying $459,690. But if we can maintain that extra balance in the offset account we actually come out ahead with the offset due to the long term interest offset which makes a huge impact towards the end of the loan, coming in at $242,177 in interest paid.

Surely that means that the offset account is a winner right? Well, we are forgetting the fact we are paying an extra $367 a month in mortgage repayments AS WELL AS having the off $90k in the offset account.

So what if we increased the basic variables repayment to $2,666p/m to match the repayments of the Offset accounts minimum repayment amount? Well, we would have that mortgage paid off in just over 23 years, save $80k in interest and put us basically square with the offset account without the need for $90k in the offset account.

Now, before we go an trade in our offset accounts for basic variable it is important to consider when you would want an offset account instead of a redraw facility only.

The biggest reason is debt deductibility, if it is an investment property loan, you want the debt to be sticky, you can take money out of an offset for non investment purposes without hassle, however if you used redraw you are technically making a new loan, one that is potentially non-deductible.

Also, if you think you are going to turn your property into an Investment Property in the future, you might want to utilise an offset account so as much debt as possible sits against the property ready for when it becomes an investment as you won’t be able to take the redraw for a deposit on your new PPOR without consequences.

Recent Comments