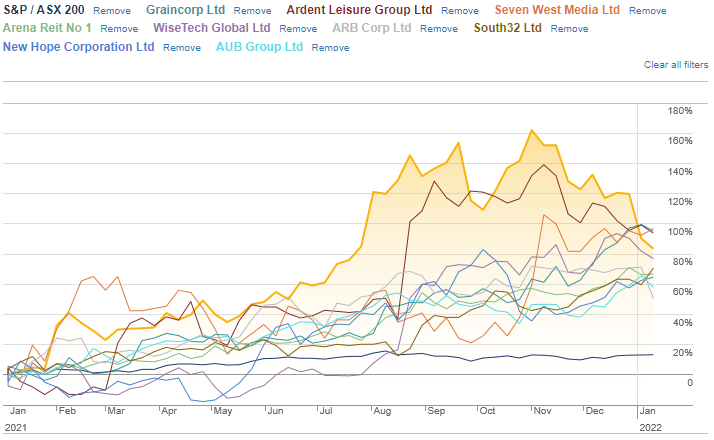

There is a saying in the industry that a rising tide lifts all ships, and 2021 wasn’t an exception. We saw the ASX200 crack double digit growth (around 17% for the year depending on you metric), but today we are going to look at the top ten stocks that did most of the heavy lifting. (much the same way dominos and Afterpay did all the hard work in 2020)

- Pinnacle Investment Management Group– Pinnacles funds saw great returns but they didn’t match the return the company had as profitability grew and market outlooks improved. This saw Pinnacle at the top of the chart with a 123.9% return for the year.

- Graincorp– Isn’t it amazing what a year of good weather can do to a share price? That being said, hopefully the current rain patterns are making it out west to ensure we have another bumper year and see if Graincorp can deliver another 101.4% return for the year.

- Ardent Leisure Group- The theme park and entertainment company saw interest from investors as people moved out of lockdown and were itching to do something exciting as we returned to a normal way of life again. This saw them shoot up by 95.7% for the year.

- Seven West Media- Two things were at play to see Seven media group make it into the list, first was the purchase of Prime Media which was/is a regional station and saw a 30% uplift from the buyout, and more importantly we saw a return on advertisement spending with business starting to ramp up again. This saw Seven West Media score a 95.5% return for the year.

- WiseTech Global Ltd- Australia’s own cloud based logistics platform has seen revenue continue to increase in the double digits with more to come as global freight continues to increase after taking a battering in 2020. This saw WiseTech almost crack triple digits and sits at an impressive 91.94% for the year.

- Arena REIT- We see a Real Estate Investment Trust make it into the list, this is their company structured vision holding their three ETFs in equal portions. They hold Childcare, medical facilities, aged care and college facilities mostly leased back through the government or other high quality tenants. This has seen them enjoy a 76.5% return for the year.

- ARB Corp- ARB the 4×4 accessory manufacturer and distributor is enjoying the consumers pent up demand for goods and the additionally savings most Aussies are sitting on, this has seen record spending for them (Also PWH) and has seen their share price increase by 72.7%.

- South32- The spin off from BHP all those years ago it mines a bit of everything (Alumina, Aluminium, Manganese, Coal, Nickle, Lead, Silver) which have all enjoyed (except Silver) the Chinese Commodity boom giving South32 an impressive 66.1% return for the year.

- New Hope Corp- Not to be confused with Episode IV of Star Wars, New Hope Corp is an exploration, development and processing company focused on Coal, Oil and Gas. It has returned what it lost during the Covid era but isn’t anywhere near it’s peak during the mining boom. It’s Covid rebound though was enough to make it on the list at an impressive 65.4% return.

- AUB Group- AUB is Australia and New Zealand’s second largest insurance broker. It has seen organic growth due to insurance premium increases and an increase on policies per client improving efficiencies. AUB might continue to grow as it continues to tap into the SME market with BizCover and a referral partnership with Kelly+Partners accounting firm. AUB rounded out our top ten still triple the index at 62.5%

Past performance is not a reliable indicator of future performance. This article is not intended to be financial advice or a recommendation of the aforementioned stocks and is purely designed for entertainment purposes.

Recent Comments