- The trajectory for inflation remains key, with markets embracing falling headline rates and central banks being wary over the persistence of core inflation pressures.

- A hoped-for pivot in the trajectory for interest rates has been replaced by “higher for longer,” which has been accentuated by stronger global growth (led by the United States) and bond supply.

- Equity markets have been embracing the soft-landing narrative: the combination of positive growth without excessive collateral damage and receding inflation.

- That narrative has become more challenged in the past week, the key challengers being inflation’s persistence, rising interest rates, the sustainability of growth amid higher interest rates, and rising concerns over China.

- The persistence of ongoing supply shocks and excess demand is a difficult inflation combination to battle, and higher bond yields appear to be part of the solution.

Economic update for Australia

The Australian economy is facing several challenges in 2023. The Reserve Bank of Australia (RBA) is keeping the cash rate unchanged at 4.10%, but it may need to tighten monetary policy further to bring inflation back to the target range of 2-3%. Inflation is still too high at 6%, driven by rising prices of services and wages.

The Australian dollar has fallen to 0.64 against the U.S. dollar, due to the strength of the U.S. economy, a slight change in tone from the RBA, and rising concerns over China’s slowdown and property market problems.

Projections for long-term interest rates in Australia have been raised, somewhat reflecting the higher starting point, though the consensus remains a declining trend over the latter part of 2023 and 2024. With inflation proving more sticky, terminal cash rate expectations are being pushed higher and for longer, which adds a bit more persistent elevation into longer-term yields.

NAB is projecting the yield on Australia’s 10-year bond, easing to 3.6% in 2024. Westpac remains at the more aggressive end, projecting 3.2%

Global influences

The Australian economy is also influenced by global factors such as the U.S. economy, the China slowdown, the Ukraine crisis, and the sustainability agenda.

The U.S. economy is growing at a healthy pace, but it faces challenges from rising inflation, supply chain disruptions, and geopolitical risks. China’s slowdown is affecting Australia’s exports of commodities such as iron ore and coal, which account for a significant share of its GDP.

The Ukraine crisis is creating uncertainty in Europe and beyond, with potential implications for energy security and trade relations. The sustainability agenda is driving changes in consumer preferences, business practices, and government policies worldwide.

Market performance and forecasts

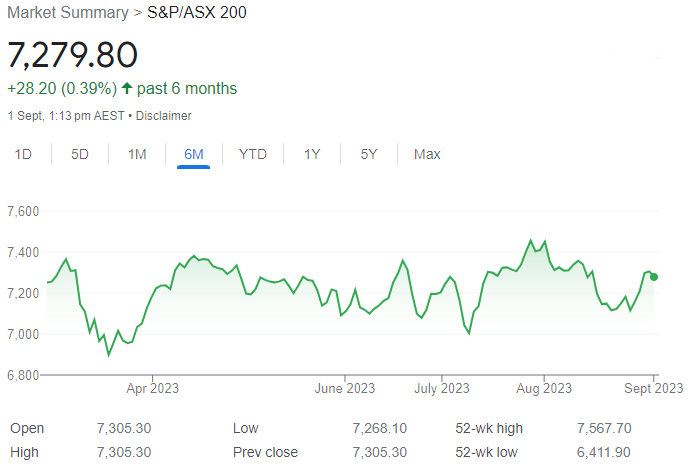

The Australian equity market has underperformed most global peers in 2023, with the S&P/ASX 200 Index up only 1.5% year to date and 0.3% up on a year ago. The ASX200 gained 2.9% for July (However down 3.6% for August), and the small caps outperformed at 3.5%, but we lagged the US.

The market faces risks from higher interest rates, cost and margin pressures, China’s structural challenges, and geopolitical tensions. However, some positive signals are coming from strong population growth, rising house prices, and better earnings results.

Westpac-MI Leading Index is flagging weak growth in 2023 extending into 2024. NAB’s business survey shows weakness in forward orders (an indicator of earnings per share). Consumption/discretionary spending remains subdued and sectoral variations are apparent.

The upcoming get-together at Jackson Hole is aptly titled “Structural Shifts in the Global Economy,” a theme pertinent to inflation sustainably returning to target. The Ministry of Foreign Affairs in New Zealand recently released “Navigating a Shifting World,” which noted three themes: shifting from rules to power, security having a bigger influence on trade, and efficiency shifting to resilience, as “just in time” becomes “just in case.” That combination signals a stronger tradable inflation pulse that we have seen in recent decades.

Given recent equity market strength, incremental uplifts from this point appear more difficult, though not impossible to achieve, and individual markets will have their own microeconomic aspects amidst an environment where the risks (inflation, growth, geopolitical) appear more elevated than three months ago. While global growth was resilient across the first half of the year, this is beginning to fade, particularly in China. Weakness in the property market continues to lead to lower growth in China, and weak growth is being accentuated by a profound shift (fall) in China’s share of U.S imports.

Recent Comments