In the haste to get to the next bull leg, financial markets sometimes can ignore the obvious. As central banks near the end of their respective policy tightening, the focus has already turned to the start of the next easing. Investors and their advisers can conveniently pass over the consequences of the tightening which can turn out to be an expensive exercise, especially when it could be someone else’s money.

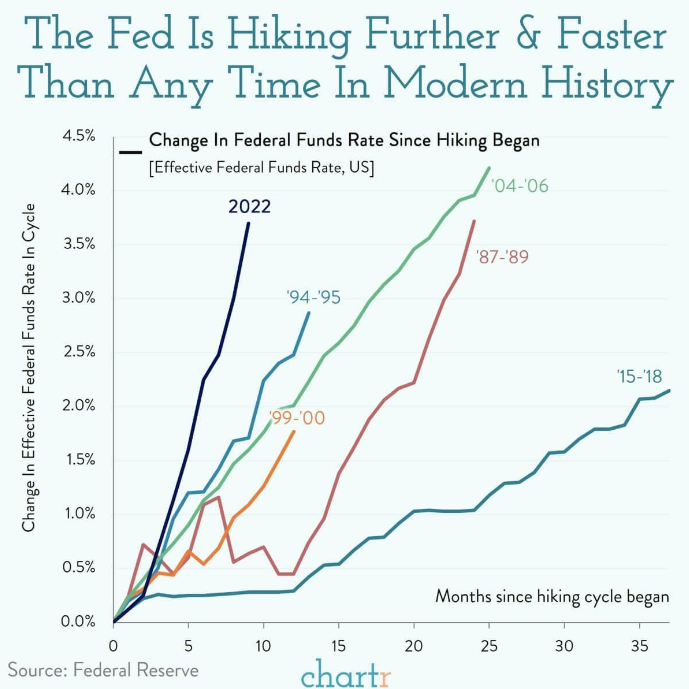

The inflationary spiral sent readings to 40-year highs and in response resulted in the most aggressive monetary policy tightening in decades. The repercussions are unlikely to be insignificant and recent banking failures are a testament. The events of the past week should remind investors to swim between the flags as dangers, visible or invisible, still lurk. Do not go flying off into the wide blue yonder until the tide goes out and the full extent of the damage is revealed. The impact on corporate earnings as margins shrink still has a way to go.

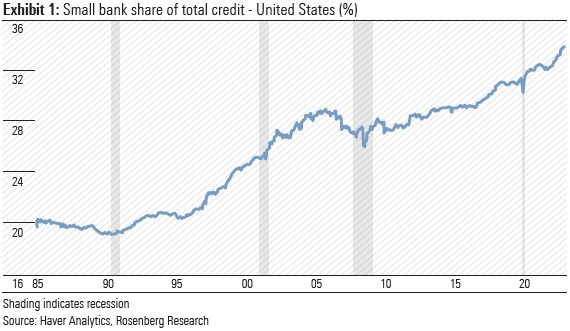

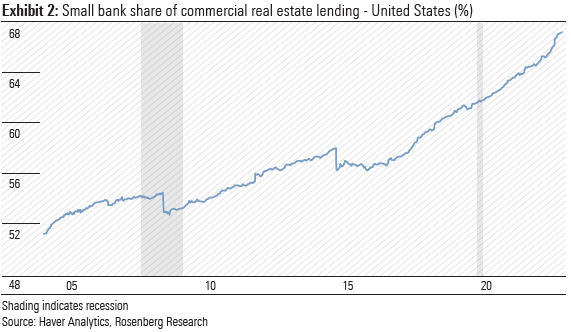

In the US a good proportion of the loan books of smaller regional banks are probably sub-prime, not residential, more likely commercial property shunned by the majors. Memories of 2008 start flooding back. The smaller banks are a crucial segment of the banking system and meaningfully larger than 2008/09. According to Federal Reserve (the Fed) data, those banks below the top 25 largest organisations account for almost 40% of all outstanding loans and two-thirds of commercial real estate lending (Exhibits 1 & 2). The likelihood of a tightening of lending standards and reduced lending to support capital ratios will have a knock-on effect throughout the US economy, which was already dealing with recessionary fears.

February’s Beige Book, which is a Federal Reserve System publication about current economic conditions across the 12 Federal Reserve Districts, included commentary of credit standards continuing to tighten and a slight deterioration in quality.

The report of the Second District, from the Federal Reserve Bank of New York stated,

“with rising interest rates, small to medium-sized banks continued to report widespread declines in loan demand across all segments, especially residential mortgages. Credit standards continued to tighten on all loan types except consumer loans. Loan spreads narrowed. Nearly all bankers reported higher deposit rates. Finally, delinquency rates rose noticeably on all types of loans.”

The Fed’s balance sheet funds the chaos

In the week ended 15 March, the balance sheet of the US Federal Reserve increased by almost US$300bn to US$8.64 trillion. An increase of US$303bn in loans to US$318bn was the culprit, after Fed data revealed banks borrowed a record US$153bn from the traditional discount facility, easily beating the previous weekly high of US$111bn at the peak of the GFC in 2008.

Notes accompanying the Fed balance sheet reveal the

“loans include primary, secondary, and seasonal loans and credit extended through the Paycheck Protection Program Liquidity Facility, Bank Term Funding Program, and other credit extensions”.

Another US$12bn was borrowed from the new emergency loan program.

Analysts estimate First Republic lost US$89bn in deposits since the run began and has borrowed billions from the Fed and the Federal Home Loan Bank (FHLB), topped up by the US$30bn from the above-mentioned big-bank consortium to plug the gap. The cost of these loans borrowings, 4.75% from the Fed and 5.09% from FHLB and market rates from other banks exceeds the 3.5% rate of return on assets in 4Q22. With the loss of deposits, the bank is probably incurring losses already. Do I hear a clock ticking?

After the collapse of SVB, Richard Clarida the former Fed vice chair and now global economic advisor to Pimco, said “whatever your views were on the odds of a recession before this, they’ve probably gone up.” It is almost certain the banking sector will now focus on supporting balance sheets and tightening credit policies. The fallout from the upheaval in the US banking sector and possible contagion risks is a credit contraction. When that occurs economic activity also contracts. The magnitude of the contraction will ultimately be revealed in subsequent GDP data.

The Fed hikes again,

As expected, the Fed raised the federal funds rate by 25-basis points lifting the rate to 4.75- 5.00%. While banking and liquidity issues persist, the increase avoids any criticism it has taken its eye off the inflation ball. The existing dot plot, which indicates one further increase to 5.00-5.25%, was unchanged. The official statement was not as important as Jerome Powell’s press conference although the chairman did reiterate “the US banking system is sound and resilient” and just a week after throwing US$300bn plus to shake off a crisis. There was a change in the forward guidance language from the “Committee anticipates that ongoing increases in the target range will be appropriate” to the “Committee anticipates that some additional policy firming may be appropriate”. The “will” to “may” is significant and one more hike will probably be it. Remember, the other option is ongoing quantitative tightening by continuing to shrink the balance sheet. The market’s reaction was dovish with the impression some conviction has come out of further rises as bank liquidity issues rise in importance. However, Treasury Secretary Janet Yellen put a spoke in the wheel saying the Treasury was not considering or working on a unilateral expansion of the deposit insurance program. In late trading, the Los Angeles based Pacific Western Bank said it had borrowed over US$15bn after a 20% fall in deposits year-to-date. The share price of the parent PacWest Bancorp fell 17%.

Game, Set, Match for Credit Suisse

Across the Atlantic, it is Game, Set, Match for almost 167-year-old Credit Suisse. Not even ambassador Roger Federer could save the imploding Swiss institution, which had not hit a winner in years. He may well have been a depositor, with career earnings of US$131m. There were too many holes in this block of Emmental variety Swiss cheese and UBS ‘picked it up’ for around US$3bn or CHF0.76 per share in UBS stock. No cash changes hands and Credit Suisse hybrid holders are entitled to be cheesed-off given they ranked above equity holders and were wiped.

Just a mere US$17bn down the drain.

Reserve Bank likely to follow the Fed

The minutes from the RBA’s 7 March meeting and the recent speech given by Assistant Governor (Financial Markets) Christopher Kent, titled Long and Variable Monetary Policy Lags, provide an insight into the conundrum facing the central bank’s board. And that is without the unwanted escalation of financial stability concerns within the global banking community.

After increasing the official cash rate at 10 consecutive meetings, the board has been somewhat frustrated with the muted impact on household spending, which is the main driver of economic demand. In more normal circumstances, consumption would have buckled. But the savings buffer households built from the fiscal stimulus packages during the pandemic and the rush to lock in fixed rate mortgage loans at historical lows, thanks to accommodative monetary policy and quantitative easing, have allowed households to continue to spend despite higher interest rates and surging inflation.

Consequently, the pain threshold has been stretched and changes in consumer behaviour delayed. In addition, the labour market remains as tight as a drum, with the unemployment rate at 40-year lows hitting 3.5%. Despite wages growth around half the inflation rate, household incomes have been relatively well supported and piggy banks raided sending the savings ratio back below pre-pandemic levels.

So, the lag effect has also been stretched and frustrating for policy makers with

“the outlook for consumption remaining a key source of uncertainty”.

But patience is a virtue and demand will slow. The global banking concerns and resultant financial market volatility throws an unwanted spanner in the works. While nearing the end of the tightening cycle, inflation remains too high. The minutes of the 7 March RBA meeting reveal only one rate option was discussed, a 25-basis point increase, but

“Members agreed to reconsider the case for a pause at the following meeting, recognising that pausing would allow additional time to reassess the outlook for the economy.”

Since the meeting, the February labour force data showed a strong rebound, and the CPI monthly indicator will be released on 29 March. Do not expect a meaningful decline in either the core or non-discretionary inflation. Most anticipate retail sales growth should have backed off in February, details released on 28 March. The Fed’s decision will also have some influence on what the RBA does on 4 April.

The counter influencing concerns of financial instability and inflation point to the conundrum facing central bank decision makers over the near term. They will be only too aware disruptions to liquidity and credit would likely bring on a recession sooner, although the tightening of credit policies by banks will have a similar impact. Should central bankers hit the pause button, they will be hoping the financial instability issues are transitory and that they do not hang around as inflation has for now on two years.

In answering questions, Kent appeared not too concerned with offshore banking issues, commenting

“what we’re talking about here is a few institutions that were poorly managed” and insisting Australian banks were sound, but adding

“It’s just one of many things the board will be taking into account when it makes its decision next month.”

Cash is an excellent alternative at present, and it provides great optionality. I continue to err on the side of caution and please swim between the flags.

Err on the side of caution and swim between the flags, Peter Wayne, Head of Equities Research, Morningstar, 23 March 2023. For the full article please visit Morningstar.

Recent Comments