I want to discuss with you a pressing matter that impacts a large number of Australians: the decline in homeownership. Becoming a homeowner is not just about having a place to live; it’s also about accumulating wealth and future stability. Unfortunately, more and more Australians—particularly young people and low-income earners—are finding it more difficult to purchase their own homes.

Why is this taking place? There are a lot of variables, however the following are some of the primary ones:

- The high price of housing in big cities, which is a result of limited supply and high demand.

- The slow rate of wage growth and growing cost of living, which make it more difficult to save for a down payment and mortgage repayment.

- The lack of social and reasonably priced housing options available to individuals unable to access the private market.

- The COVID-19 pandemic’s effects, which have impacted the housing market, raised unemployment, and decreased income.

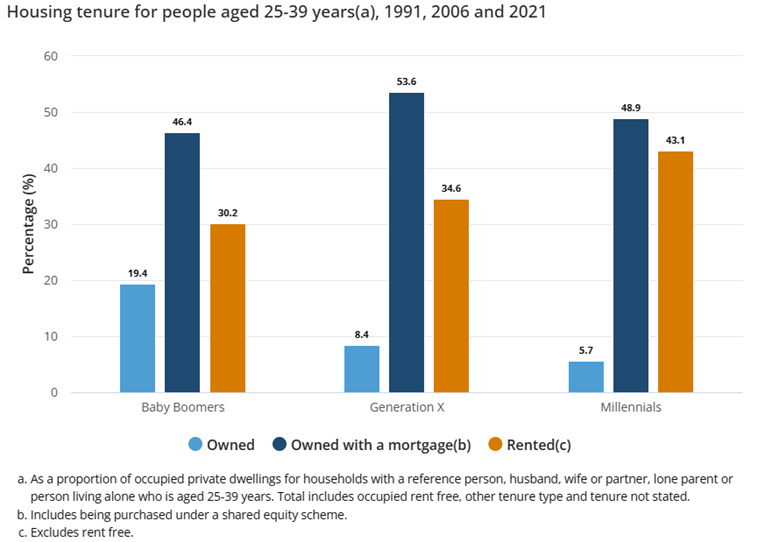

Given all of the above, it is evident that the percentage of Millennial homeowners has been steadily declining over the years, with a notable decline in mortgage-backed property ownership from Generation X and a notable rise in millennial renters.

What are the consequences of this trend? They are not pretty, I can tell you that. Falling homeownership means:

- More individuals will be forced to rent for an extended period of time or forever, putting them at risk of unstable housing, escalating rents, and subpar housing.

- A greater number of retirees will have fewer assets and money when they do, which will lower their standard of living and make them more dependent on the pension system.

- More people will experience stress and hardship related to housing, which may have an impact on their social inclusion, wellness, and health.

This is a comparison between renting and owning a property. You can see that, depending on your situation, renting without owning a property may not be an option for you in the long run, and you will experience financial shortfalls. If you do, however, own a home with identical conditions (In this situation we have purchased a house with a mortgage 9 years out from retirement), you will discover that there are solutions available and that you are only very slightly short. Additionally, your net worth has increased because you own your own property rather than renting one.

Owning a Home

Renting

What steps therefore can we take? Although there aren’t any simple answers, we must move quickly and decisively as a group. The elected officials must tell us what steps they are doing and what steps they intend to take to resolve this issue. As the federal government has the authority and duty to establish the country’s housing policy, we must insist that it take more action. In order to provide housing services and control the housing market, we must assist state and municipal governments. Additionally, we must cooperate as a community in order to push for change, spread awareness, and share our personal stories.

I’m writing this to ask you to join me in conversation, which is why I’m doing it. Please share your thoughts on this matter, how it affects you or someone you care about, and what you would want to see happen. By working together, we can ensure that every Australian has an equal opportunity to become a house owner.

If you have any questions or need further assistance, please contact us today. You can also browse our other blog posts for topics that may be of interest to you.

Recent Comments