Rates

The Federal Open Market Committee (FOMC) decided not to change the federal funds rate after its meeting in December. With market expectations pointing to a 90 basis point reduction and a 50% chance of the first cut happening in May, this decision sparked discussions about potential rate cuts in 2024. The market’s belief that the Fed has stopped raising interest rates and the US GDP’s recent strong 4.9% growth are at odds with this debate. The author queries the justification for rate cuts in light of the current high levels in US equity markets, the Fed’s quantitative tightening programme, and ongoing excess liquidity.

The monetary expansion initiatives of central banks, sometimes referred to as “central bank puts,” made the period following the Great Financial Crisis (GFC) unique and unheard of. However, it doesn’t seem likely that we will see a return to zero-bound interest rates and quantitative easing given the still enormous central bank balance sheets. Rather, it implies that things are starting to return to normal.

There are issues in the US government debt market due to the Fed’s ownership of more than 20% of the country’s debt and an increase in supply. Corporate profits could be under pressure from slower economic growth, and some companies might even go into a “zombie” state where they can no longer make interest payments.

In line with a cooling labour market, the non-farm payrolls for October showed indications of a slowdown in job growth and fell short of projections. China’s erratic trade statistics indicate the country’s ongoing economic problems, which include a decline in the trade surplus, weak exports, and a housing slump that has an impact on the real estate sector.

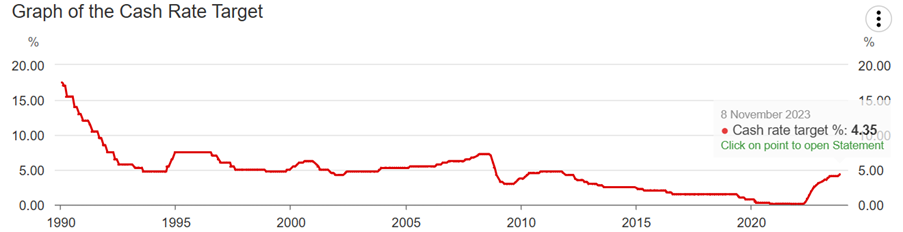

The Reserve Bank of Australia (RBA) raised the official cash rate in Australia to 4.35%, citing increased expectations for inflation. The article suggests that banks, especially the Big Four, should raise deposit rates in line with lending rates.

Real-estate and Infrastructure

The S&P/ASX200 A-REITs has risen strongly so far in November, up 12.4%, reversing trends seen over September and October. The index is up 3.6% for the year to date and 2.3% on a year ago.

The FTSE EPRA Nareit Global Real Estate Index in U.S. dollars (total return) has risen 8.7% so far in November, reversing declines over the two preceding months, with a quarter to date move of 3.4%. The index is down 1.1% for the year to date and 2% on a year ago. Strength in November has been strong in Europe and the United Kingdom.

The S&P Global Infrastructure Index in U.S. dollars has followed global moves shifting higher in November (up 6.2% for the month to date), reversing falls seen over August, September, and October. The index is down 4.2% for the year to date and 4.6% lower than a year ago.

The defensive characteristics of infrastructure were apparent in the month of October with the MSCI World Core Infrastructure Index (USD net index) outperforming the MSCI World Index (negative 0.3% versus negative 2.9%). Infrastructure has underperformed for the year to date and on a 12-month basis.

The outlook for infrastructure remains mixed. There are the obvious long-term opportunities, and infrastructure has many defensive characteristics that are attractive in a world facing considerable uncertainty and inflation, with little room for policy error.

Infrastructure remains a critical component of the world economy and society. GI Hub notes a $15 trillion investment gap in U.S. dollars. Themes such as transport decarbonization, energy transition including electric vehicle charging assets, digitization, and the circular economy are bringing new forms of infrastructure investment. These are adding to the traditional infrastructure sectors including regulated utilities, roading, and airports.

Australian Equities

The S&P/ASX200 has mirrored November’s global optimism, rising 4.1% for the month to date though flat over the quarter and up 0.3% for the year to date.

The ASX 200 declined 3.8% in October following weakness in September, as Australian equities underperformed broader global indexes with earnings a headwind. Those monthly declines at least helped improve valuations.

Tighter financial conditions are starting to bite, and growth in the Australian economy is expected to remain below trend over 2023 and 2024, with a combination of cost-of-living pressures and higher interest rates exerting a restraining influence on demand and consumption.

Faced with a stickier inflation story in the third quarter, the RBA responded with the inevitable hike in November, and market pricing is assigning a reasonable probability to a follow-up move, which is counter to expectations for the Fed, European Central Bank, Reserve Bank of New Zealand, and Bank of England, who are seen as done.

Higher mortgage costs are putting pressure on household consumption and discretionary spending, accentuated by elevated cost-of-living expenses, which is a bad combination for disposable income. These pressures will continue into year-end and early 2024, affecting economic growth over coming quarters.

If you have any questions or need further assistance, please contact us today. You can also browse our other blog posts for topics that may be of interest to you.

Recent Comments