Are you aware that your employer is obligated to contribute 11% of your Ordinary Times Earnings (OTE) into your superannuation fund on your behalf?

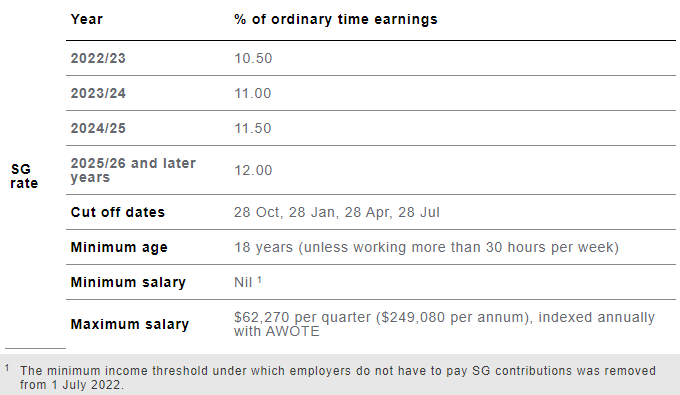

The Superannuation Guarantee (SG) is a required retirement savings program for Australian workers. Employers are required to contribute a minimum percentage of their employees’ regular time wages to a superannuation fund. The SG rate is currently 11% and is expected to progressively rise to 12% by 2025.

The SG program is designed to supplement the Age Pension and any other retirement savings that you may have. It also contributes to reducing reliance on the public pension system and increasing the national savings rate.

The SG applies to most employees and to some contractors who are considered employees for SG purposes. Employers must make SG contributions at least quarterly, by the 28th of the month after the quarter’s end. If they do not, the Australian Taxation Office (ATO) may levy penalties and charges against them.

On May 2nd 2023 it was announced by the Australian Government that, beginning 1 July 2026, employers will be required to pay employees super at the same time they are paid salary and wages, rendering the quarterly cut off dates above redundant.

As an Employee you have the option of choosing which superannuation fund you want your SG contributions paid into, as long as the fund meets certain standards and rules. You can also make voluntary contributions to your superannuation fund, either before or after tax, subject to specified restrictions and conditions. If you want to learn more about making your own contributions to super click here.

Superannuation is a long-term investment with considerable financial implications. As a result, it is critical to understand how the SG operates and how it affects you.

Recent Comments