This tax year, it has come to my attention that we need a bit of a refresher on how the Australian Income Tax System works, the difference between deductions and credits, and why we are all sad to see LMITO go.

Our Tax System is Progressive

So, this is the first thing to note, our system is a Progressive system, unlike GST which is known as a regressive system. It is progressive as the more you earn, the more appropriately you pay in tax as dollar terms and % wise. It is easy to remember, because a progressive tax system gets progressively more expensive. Simple.

However a good accountant friend will always remind me, that hidden in the tax you pay, is the tax you don’t have to pay and that is what we are going to talk about.

It’s a write-off

Let’s talk about deductions and the PAYG tax system. Most of Australia’s population is employee based which means we use the Pay As You Go (PAYG) tax system where your employer withholds part of your pay each year, and gives it to the tax man. You then get a certificate of how much you Grossed, Tax Withheld and any other auxiliary benefits.

And along the way, you may have incurred personal expenses such as your phone, self education expenses etc which you can then claim come tax time.

This is what people call a write-off, and somewhere along the lines we lost the meaning of what a deduction does.

A Deduction lowers your Taxable income, it is not a tax credit.

What I mean by that, is if we earnt $100,000 we would pay tax of about $25,000 (including Medicare) which would have already been withheld by the employer, so in essence, no tax bill when you lodge. But if we had $10,000 of deductions, our taxable income would be $90,000, which means a tax bill of $21,500, but since our employer withheld $25,000 we will get $3,500 back when we lodge our tax return. We won’t ever get the whole $10,000 back, as it is just reducing your taxable income of which your tax is calculated on.

Marginal Tax Rates

There is a rough and ready way to see what expenses will lead to money back from the tax man, and that is about understanding your marginal tax rate. As mentioned, the rate of tax we pay goes up in bands, and the Marginal Tax Rate (MTR) refers to the current band you are on. So, in our example above, we are on the 32.5% tax band, throw in 2% Medicare levy for good measure and ignoring some rounding we are at 35% back for every dollar spent.

As mentioned it is a bit of a rough and ready rule and wouldn’t take into account if you move brackets due to deductions (which can happen).

Tax Credits – The good stuff

We do have Tax Credits in our system which are dollar for dollar, and the most prominent one being our Franking System. If you receive dividends from Australian Companies, it will most likely come with some franking credits. You will receive a dividend statement which will outline the Gross Dividend, Franking Amount, and net received. Most companies pay a tax rate of 30% and then are paying profits out to share holders, the idea of our franking credit system is so you don’t get double taxed. To do that, you get the 30% tax that the company paid as a tax credit, and add that in to your tax return. So, back to our example of earning $100k, with $25k already withheld, we also received $1,000 Gross dividend, at our tax rate we would have to pay $350 in tax on that, however, we have a tax credit of $300 already because it is franked, so we are just out of pocket $50. Much better than what could otherwise be only receiving $700 cause the company paid tax, then we pay tax on the whole $700 ($245), which is what would happen without our franking system.

It gets even better if you are in a zero tax environment as you get that money back!

What happened to the Low-Middle Income Tax Offset

Unfortunately the $1080 non-refundable tax offset we had been enjoying for the past couple of years expired. Coincidently, the Lib’s had it expire in their last year, and it wasn’t renewed in Labor’s Budget that was announced in May 2023. This means that we won’t see that extra refund that we enjoyed over the previous years.

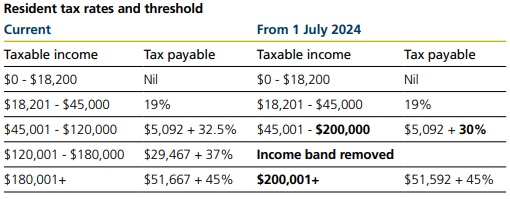

The reason why it was removed is because from 1 July 2024 we will move to the stage three tax cuts which sees the 32 and 37 tax rates removed and replaced with a single 30% tax rate all the way to $200,000. Doesn’t help us in the year just finished and this year, but at least relief is still on it’s way.

What can I do to lower my personal tax paid?

Well, you can spend money on deductible expenses, but remember, you don’t get it all back, so you need to ensure you are buying things you actually need, and not doing it for some money back at tax time.

Contributing to Superannuation is a good idea aswell, because at least the money remains yours and instead of spending you are effectively locking it up for your future self.

Income Protection policies, if these are held personally they are tax deductible to you (not the whole policy due to stamp duty and other fees), but having it packaged personally instead of super and offer a better policy, plus a neat tax refund at the end of the year.

The important thing to remember though is that great tax planning starts at the start of the year, not in June. So since we are in July lets talk about what we can do to better tax plan, this can be done with the team at Funded Futures and our associated accountants, or you can talk to your own accountant directly and see if they can assist you with tax planning.

Recent Comments