How to set your financial goals

The only wrong way to set a goal is to not set a goal at all.

So today I want to introduce two different frameworks you can use to help set your own goals and give them the meaning required to work towards completing them.

SMART Framework

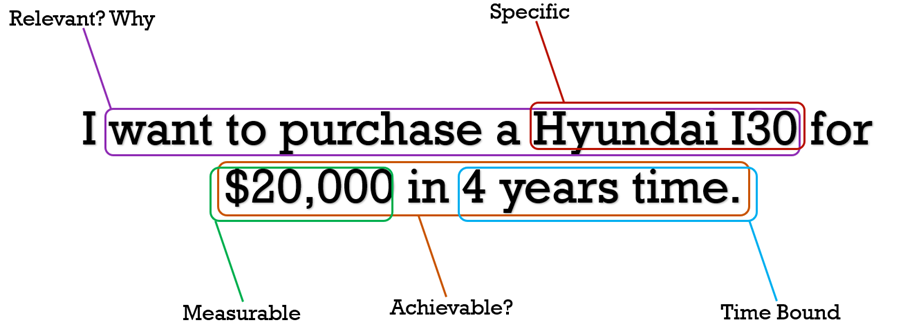

You need an efficient plan if you want to reach your objectives. SMART goal setting framework is one of the most widely used and useful goal setting techniques. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Let’s examine each of these steps and how they might support you in establishing and achieving your objectives.

The SMART framework is outcome focused, and you track your progress.

Specific: Your objectives must be precise and well-defined, not vague or unclear. Say you are saving for a car, instead of it just being “save for a car” state what sort of car you are working towards. This also helps you visualise your goal.

Measurable: Rather than being meaningless or subjective, your goals should have measurable criteria of progress and achievement. Keeping with our car example, if you are specific about the car you want to buy, you know the value of need to save for. Doing so makes the goal measurable.

Achievable: Rather than being impractical or unattainable, your goals should be reasonable and reachable. Are you saving for an Audi on a Hyundai budget? The goal you set should be challenging, but not unachievable, if it is too difficult you will end up losing focus. (think of it like highly restrictive diets, they usually end in a blowout/binge eating session).

Relevant: Rather than being unrelated or contradictory, your goals should be in line with your beliefs and purpose. Saying “I want to learn how to play the guitar because it will help me express myself creatively and connect with other musicians” is a better example of what you should say when expressing your desire to study the instrument.

Time-bound: Rather than being open-ended or unclear, your goals should have a set limit or time period. For instance, you ought to state something like “I want to visit 5 countries in Europe by the end of next year” as opposed to “I want to travel the world someday”.

Using the SMART framework can help you create more effective and meaningful goals that will motivate you and guide you towards success. Try it out for yourself and see the difference it can make in your personal and professional life.

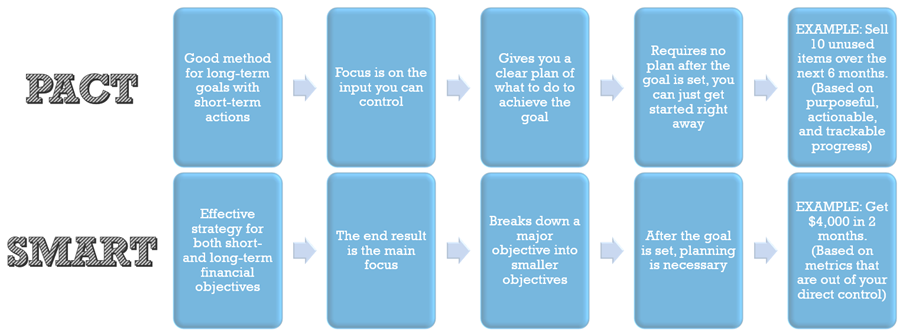

PACT Framework

If you’re more output focused than outcome focused, then the PACT Framework might be more ideal for you.

Purposeful: Meaningful, long-term, and aligns with your passion; ask yourself does this fit with your long-term goals? Think about the problem you are trying to solve, or that long term goal (could be a smart goal) you are trying to achieve.

Actionable: Based on outputs and the actions taken to achieve it; ask yourself would you rather take action today than over-plan tomorrow? An actionable output is as simple as “put $50 a week into a savings account”.

Continuous: Consistent actions, simple and repeatable; ask yourself what actions can you take that will help you achieve your goal? This is another bit that really sets PACT apart from SMART, is the goal of $50 a week something that can be consistently done?

Trackable: More of a “yes” or “no” approach, not measurable; ask yourself have you done the thing today? Yes or no? This makes your progress easy to track. Have I saved $50 this week, yes or no? much easier to track then “purchase a Hyundai i30 in 4 years for $20,000”)

Both the SMART and PACT framework have their uses, and ideally, they should be set together, with the SMART goal giving the overall long-term direction, and the PACT goals being something that is easily trackable from an output perspective.

Think of it this way, a SMART goal could be “I want to retire from work at age 55 and receive an income of $100,000 to meet my living and lifestyle expenses.”

How would you tackle that? Well, you could then use the PACT framework to set multiple goals that would help you achieve it such as:

I want to make additional contributions to my superannuation fund of $200 a month from now until age 55.

I want to increase the repayments on my mortgage to $800p/w so I can pay off my loan before at 55.

This helps break that large goal into smaller, easy to track steps that you can check off.

If you have any questions or need further assistance, please contact us today. You can also browse our other blog posts for topics that may be of interest to you.

Recent Comments