The fight against inflationary pressures is a journey that central banks have been on for over a year1. The Reserve Bank of New Zealand was the first to move in October 2021, followed by the US Federal Reserve and the Bank of Canada in March 20221. Australia’s Reserve Bank didn’t budge until seven months after its New Zealand counterpart, in May1. The European Central Bank was slowest off the blocks in July 20221. While the end target is important, the battles along the way need to be progressively won1. The first should be to get the headline inflation rate below the official cash rate and then move to the preferred core or trimmed mean benchmark, until the longer-term goal is in sight1. But a year down the track and aggressive monetary policy tightening, not one central bank has the headline inflation rate below their individual official cash rate1. While there is a delayed impact following the series of rate hikes and the headline inflation rate has peaked, it is still too early to declare victory1. Most of the easing in inflation from the peak has come from the supply side rather than weakening demand1. There is an element of stubbornness in the core readings and any relaxing may force an embarrassing reversal before the preferred benchmark sits back comfortably within the long-term target range1.

The US 2Q23 earnings season has started and big banks were the first to report their earnings1. JPMorgan featured with its shares rising 7.6% on the result1. Wells Fargo and Citibank also beat expectations, with positive loan growth and widening net interest margins1. However, there is increasing pressure on deposit rates suggesting the margin tailwinds are about to abate1. The combined US$5.5bn increase in loan loss provisions by the three banks was the largest since 2Q201.

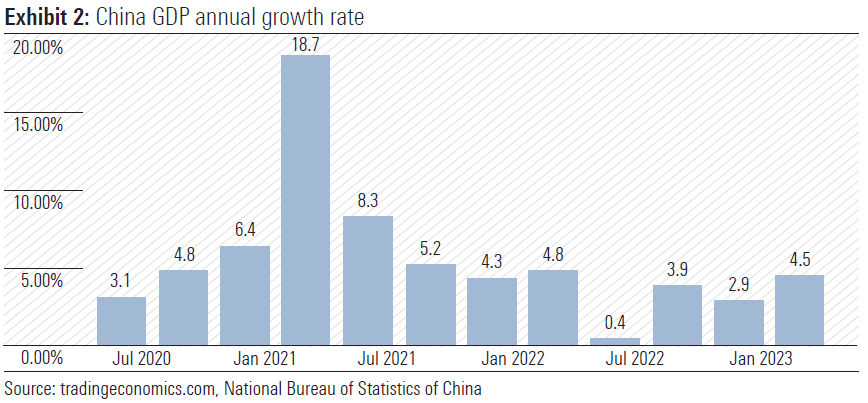

According to a report by Reuters, China’s economy grew at a faster-than-expected pace in the first quarter of 2023, with GDP expanding by 6.5% year-on-year1. This was higher than the median forecast of 6.2% in a Reuters poll of economists1. The report also states that China’s economy has been recovering from the pandemic-induced slowdown and that the government has been taking measures to support growth1.

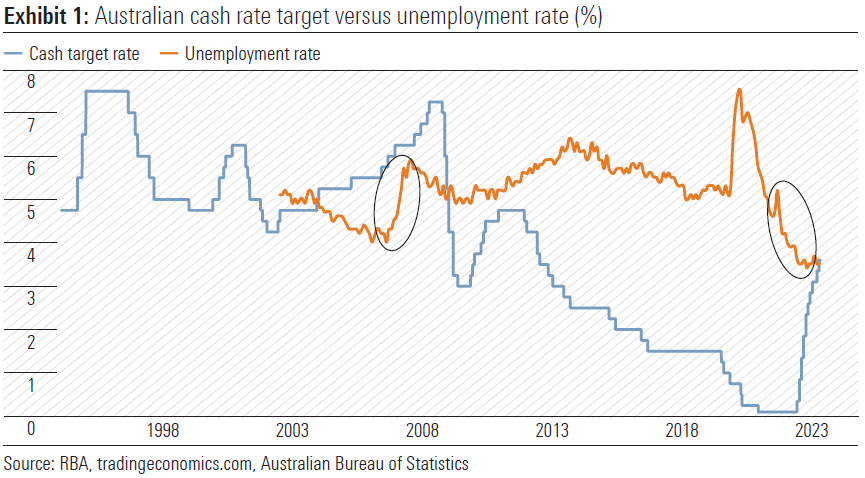

Minutes of April’s Monetary Policy meeting reveal the pause decision was finely balanced and another increase on 2 May is not out of the question but is still data dependent. The March quarter CPI to be released on 26 April will be critical, while a tight labour market and a 3.5% unemployment rate should keep the doves on edge and the hawks on the wing. Inflation risk remains tilted to the upside.

In addition, meaningful wage increases being demanded by unions cannot be ignored and sharply increased immigration numbers are already putting pressure on rental rates and housing stock. Falling house prices are tending to bottom, which will also provide some support to an eroding wealth effect.

An increase in May is more likely than not and ‘higher for longer’ remains the base case.

Peter Warnes is Head of Equities Research, Morningstar Australasia, Morningstar Australia, “This time it is different – Record low unemployment, despite sky-rocketing interest rates” 16 April 2023

Recent Comments