Medicare Levy and Medicare Levy Surcharge is NOT the same thing! Let’s find out the difference together and which one we can avoid paying.

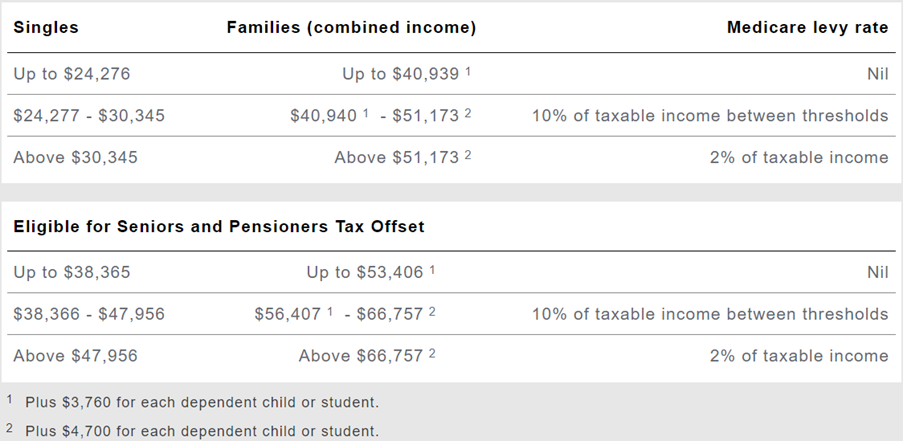

The Medicare Levy rate varies based on your or your family’s income level. It is collected from you in the same way as income tax and it is used to help fund the public health system. For the 2022–23 income year, the income thresholds and rates are as follows:

This data is for 1st July 2022 to 30th June 2023.

The purpose of the Medicare Levy Surcharge is to encourage individuals to take out private hospital cover, and where possible, to use the private system to reduce the demand on the public Medicare system. If you have private hospital cover, you can avoid paying the surcharge, as well as get access to more health services and benefits.

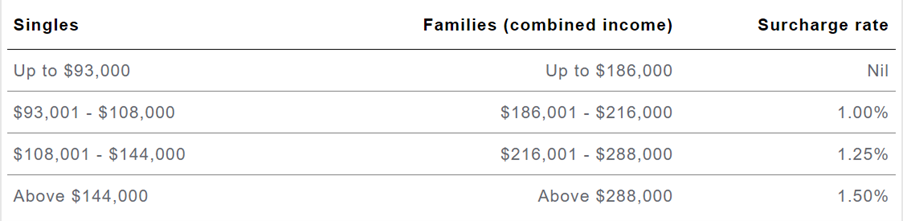

The income thresholds and rates for the Medicare Levy Surcharge are different from the ones for the Medicare Levy. They also change every year. For the 2023–24 income year, the income thresholds and rates are as follows:

To calculate your income for Medicare Levy Surcharge purposes, you need to add up your taxable income, reportable fringe benefits, total net investment losses, reportable super contributions, and any exempt foreign employment income.

If you want to avoid paying the Medicare Levy Surcharge, you need to have private hospital insurance cover that meets certain criteria, an extras policy will not suffice. The cover must have an excess of no more than $750 for singles or $1,500 for couples/families per year. It must also provide benefits for hospital treatment in an Australian hospital or day hospital facility.

There are many benefits of having private hospital insurance cover besides avoiding the surcharge. You can choose your own doctor and hospital, have shorter waiting times for elective surgery, get access to a wider range of services such as dental and optical, and get rebates from the government depending on your age and income.

If you are interested in getting private hospital insurance cover, you can compare different options and find the best one for your needs and budget at https://privatehealth.gov.au/.

Recent Comments