If you’re thinking of retiring soon, you might want to know about the Transfer Balance Cap (TBC) for pension accounts in Australia. It’s a limit on how much money you can transfer from your superannuation account to your pension account. Why does it matter? Well, because the earnings on your pension account are tax-free, while the earnings on your super account are taxed at 15%. So, the more money you have in your pension account, the less tax you pay.

The TBC was introduced in 2017 at $1.6 million and it’s indexed to inflation. As of 1 July 2023 current cap is $1.9 million, this means that you cannot transfer more than that amount into pension from superannuation phase.

As the name suggests, it is a TRANSFER balance Cap, which means we are only interested in the amount that commences the pension and if any money has come out of the pension, however, this is where it gets tricky.

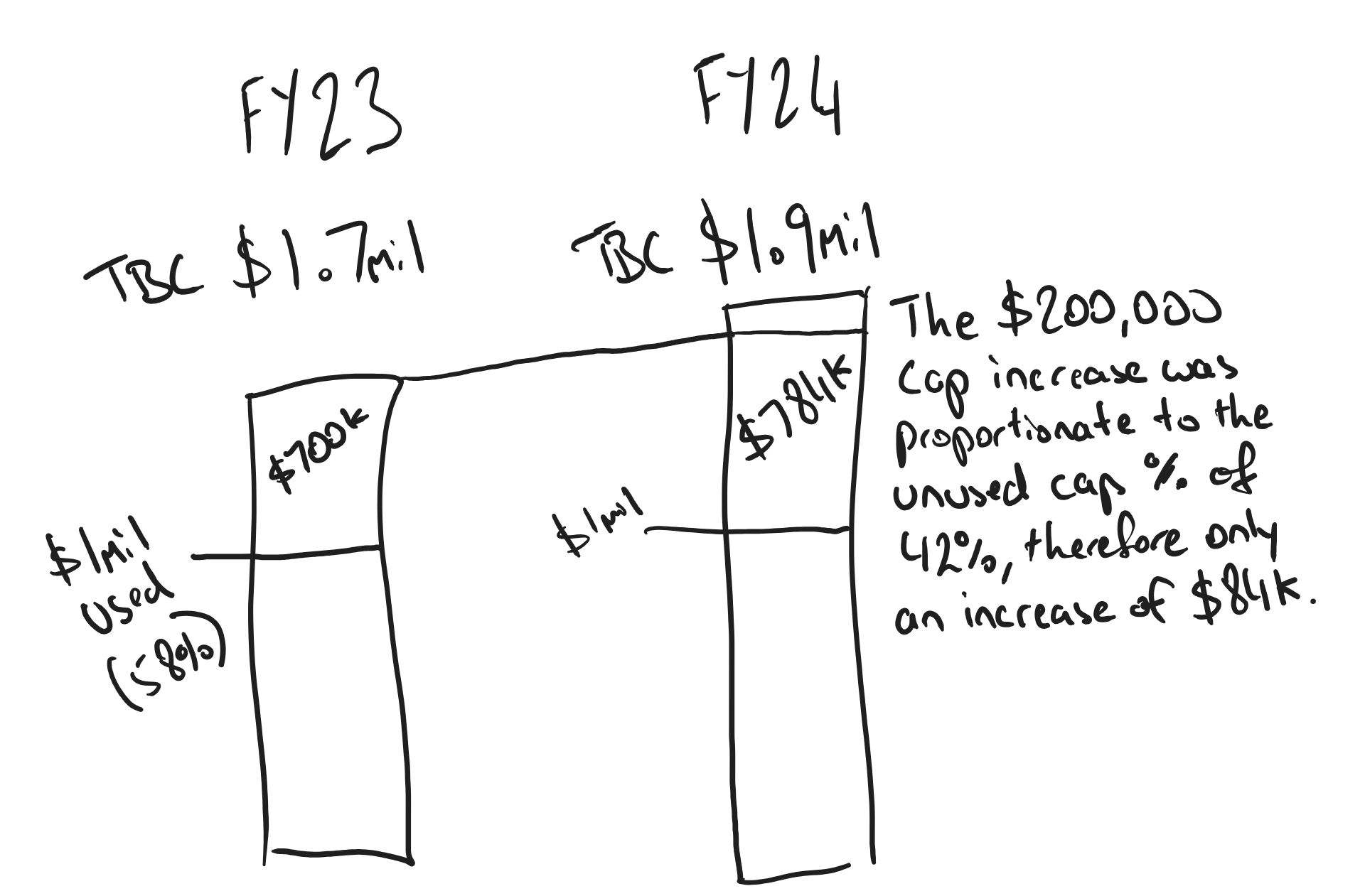

If you started your pension back when the TBC was $1.6million and you used the whole cap, that is it, even through the TBC limit is now $1.9million, you have no available cap to index with inflation, if you only used a portion of the cap, the remainder will index with inflation giving you slightly more cap, but it won’t be the $1.9million limit.

It is important to note how much you transferred to your pension as it doesn’t matter if the value of your pension becomes greater (due to investment returns), so much so, your pension value can exceed the TBC value without trouble, again, to reiterate, the TBC is only interested in the transferred value.

The next tricky bit is debts against the TBC, there are three ways to take money from a pension, Transfer back to Super, which will debt back against the TBC for the value transferred, draw an income stream (which is mandatory and has minimums) this doesn’t debt the TBC, and finally commutations, which is a fancy name for a lumpsum withdrawal, this again, will debt your TBC value.

So why is any of this important? We’ll as illuded to earlier, we want as much in pension phase as possible as it is zero tax on earnings, compared to super accumulation phase which is 15% tax. Next, if we have more than the TBC value in super, we want a plan to mitigate as much tax as possible, and may utilise a partners TBC if available.

And finally, if you or your partner passes away, you might inherit a death benefit pension (via a reversionary nomination), and then their balance is added towards your TBC, which means you might need to withdraw some funds to stay under the cap.

The TBC can be tricky to understand and apply, so it’s best to get professional advice before you make any decisions about your retirement income. You don’t want to end up paying more tax than you need to, right?

Recent Comments