- The onus will be on inflation outcomes to validate market expectations with core inflation measures globally still elevated.

- Growth in Australia is weak, inflation pressures are receding albeit gradually, and the slow return to the inflation 2.5% target remains a concern. Interest-rate relief is likely to lag global peers.

- Election and political risk are expected to become more relevant internationally, with half the world’s population and around 60 countries going to the polls in 2024.

- The diversion of sea traffic from the Red Sea to around the Cape of Good Hope is a reminder of geopolitical frictions, which have lifted freight rates, and represent another small “supply shock” on top of what is becoming repeating supply shocks.

- The path returning inflation to target still faces geopolitical challenges. Labor markets remain very tight, adding to service inflation.

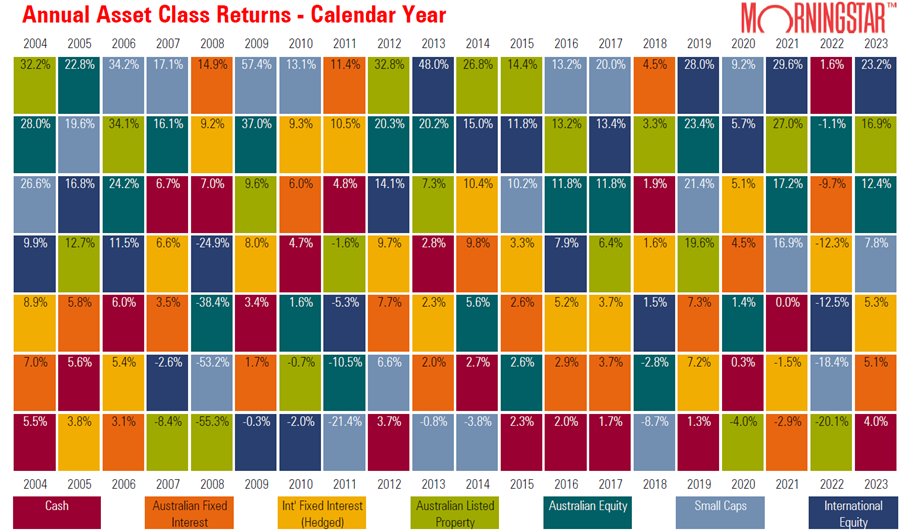

- There appears a wider than normal array of views over the macroeconomic outlook in 2024, which supports diversification in portfolios, and increasing attention to microeconomics such as business fundamentals and valuations.

Australia Cash and Fixed Interest:

The Reserve Bank of Australia (RBA) has shown cautiousness regarding interest rate changes despite global sentiments favoring rate reductions due to lower inflation. Economic indicators like weak third-quarter GDP growth and maintained RBA tightening bias suggest potential rate cuts in the future. Bond market trends, especially influenced by the U.S. Treasury market, have seen yields fluctuate. The Australian dollar’s stability depends on interest rate expectations and central bank policies.

The Australian market is influenced by global trends, particularly expectations of rate cuts by the U.S. Federal Reserve. Predictions indicate a smaller rate reduction by the RBA compared to the Fed due to Australia’s relatively lower cash rate and higher core inflation. Weak economic data, alongside other factors like consumer sentiment and inflation figures, contribute to the anticipation of rate cuts. While growth remains subdued, demand levels are still relatively high. Projections suggest lower interest rates and a stable Australian dollar in 2024.

Australian and International Property:

Real estate markets, particularly in Australia, experienced growth in December, driven by expectations of lower interest rates. International property indexes also saw positive performance, with Europe and the UK leading the trend. However, caution prevails in 2024, with slight declines observed in some indices.

Expectations of lower interest rates continue to support the property sector, particularly in Australia, amidst ongoing economic uncertainties. Commercial real estate markets face challenges but are expected to improve later in the year, presenting opportunities for well-capitalized investors.

Global Infrastructure:

Infrastructure investments performed well in late 2023, although they underperformed throughout the year due to rising interest rates. Despite robust fundamentals, the sector faced challenges, including slow transaction rates.

Long-term prospects for infrastructure investments remain positive due to underinvestment, climate change concerns, and technological advancements. However, challenges such as project financing and geopolitical uncertainties persist, requiring a long-term investment approach.

Australasian Equities:

Australasian equities ended 2023 on a strong note after a period of underperformance. The late-year surge narrowed the gap with global peers, but cautiousness prevails in 2024 due to various economic factors.

Despite cheaper valuations, challenges persist for Australasian equities, including sluggish economic growth and high inflation. Prospects for interest rate relief are anticipated, but uncertainty remains, particularly regarding productivity growth and future monetary policy decisions.

International Fixed Interest:

Bond markets saw a strong end to 2023, driven by expectations of interest rate cuts. However, optimism was tempered by stronger-than-expected inflation figures, signaling ongoing uncertainty in the market.

Expectations of modest easing cycles and returning central bank rates to neutral settings influence short-term interest-rate expectations. However, market vulnerability to higher-than-expected growth or inflation outcomes persists, necessitating cautiousness.

International Equities:

Global equity markets ended 2023 positively, supported by lower inflation trends and expectations of rate cuts. However, cautiousness prevails in 2024 due to geopolitical uncertainties and reassessment of interest rate expectations.

While optimism exists for global equity markets in 2024, challenges such as rich valuations, geopolitical risks, and inflationary pressures remain. Varied views suggest a need for active investment strategies amidst macroeconomic uncertainty.

Recent Comments