You might find it interesting to know that, starting on July 1, 2024, the annual contribution caps for superannuation, which you may be using to save for retirement, will rise. This implies that you can increase the amount you contribute to your super and take advantage of the tax benefits.

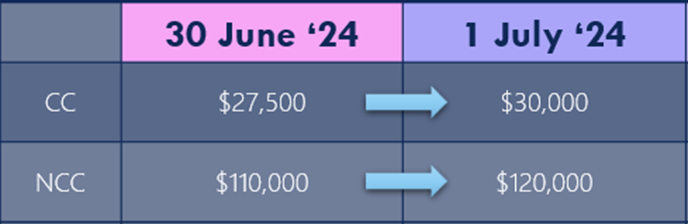

The maximum amount that you can contribute to your super from your pre-tax income, including employer contributions, salary sacrifice plans, and personal contributions that you can deduct from your taxes, is known as the concessional contributions cap. As of the 2023–24 financial year, the concessional contributions cap is $27,500; however, on July 1, 2024, it will rise to $30,000. In your super fund, concessional contributions are typically taxed at a rate of 15%, which might be less than your marginal tax rate.

The maximum amount that you can contribute to your super from your after-tax income, including government co-contributions, spouse contributions, and personal contributions that aren’t deductible, is known as the non-concessional contributions cap. As of the 2023–24 fiscal year, the cap on non-concessional contributions is $110,000; however, as of July 1, 2024, it will rise to $120,000. Unless you surpass the cap, non-concessional contributions remain tax-free in your super fund.

This means that, preventing a trigger by June 30, 2024, the three-year bring-forward limits will also rise from $330,000 to $360,000. In that case, the $330,000 cap will remain in effect.

The increase in the contribution caps is due to indexation, which is a process of adjusting the caps in line with inflation and wage growth. Indexation ensures that the caps keep pace with the changes in the cost of living and average earnings. Indexation also affects other superannuation rules and thresholds, such as the total superannuation balance and the transfer balance cap.

Ending 30 June 2024

| TSB @ Previous 30 June | Max NCC |

| Less than $1.68m | $330,000 |

| $1.68m to under $1.79m | $220,000 |

| $1.79m to under $1.9 | $110,000 |

| $1.9m and over | $0 |

Commencing 1 July 2024

| TSB @ Previous 30 June | Max NCC |

| Less than $1.66m | $360,000 |

| $1.66m to under $1.78m | $240,000 |

| $1.78m to under $1.9 | $112,000 |

| $1.9m and over | $0 |

Read our other blog about Concessional and Non-Concessional Contributions here.

Recent Comments