Australian taxpayers may be aware of the upcoming stage 3 tax cuts, which are scheduled to take effect on July 1, 2024. These tax breaks are a part of a larger tax reform programme that was first unveiled in 2018 and 2019 by the Coalition government and has since been updated by Prime Minister Anthony Albanese’s current Labour administration.

The stage 3 tax cuts aim to reduce tax for most individuals, simplify the tax system and protect middle-income earners from bracket creep. Bracket creep is when someone ends up paying a bigger fraction of their income in tax because of a marginal pay rise.

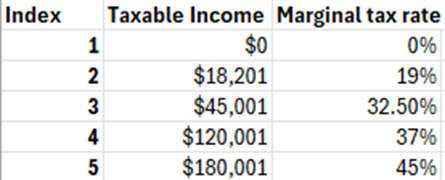

Current resident individual tax rates:

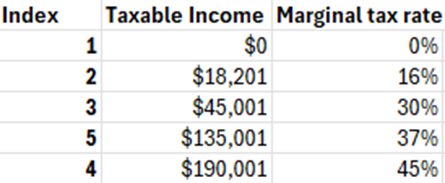

Here’s how the new stage 3 tax cuts will affect you, depending on your income level:

– If you earn up to $18,200, you will pay no tax, as before.

– If you earn between $18,201 and $45,000, you will pay a 16 per cent tax rate on each dollar over $18,200. This is a 3 per cent reduction from the previous 19 per cent rate.

– If you earn between $45,001 and $135,000, you will pay a 30 per cent tax rate on each dollar over $45,000. This is a 2.5 per cent reduction from the previous 32.5 per cent rate.

– If you earn between $135,001 and $190,000, you will pay a 37 per cent tax rate on each dollar over $135,000. This is a new tax bracket that was not part of the original stage 3 plan.

– If you earn above $190,000, you will pay a 45 per cent tax rate on each dollar over $190,000. This is the same as before.

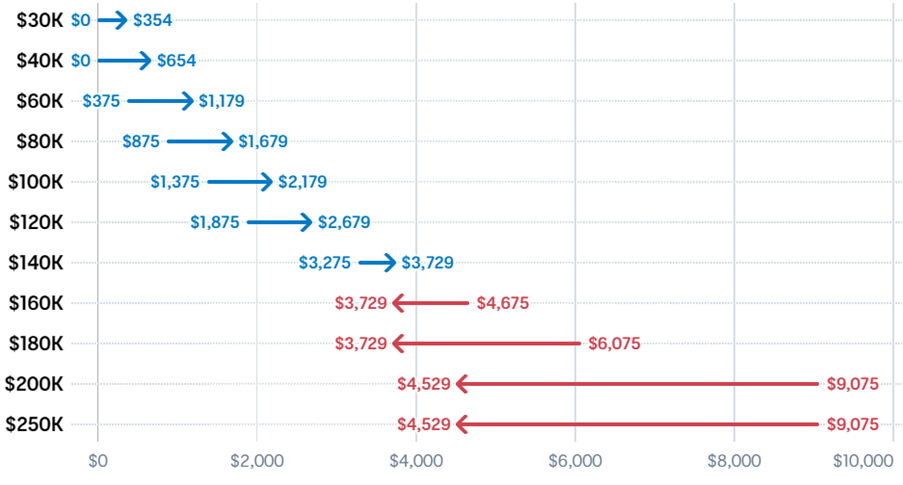

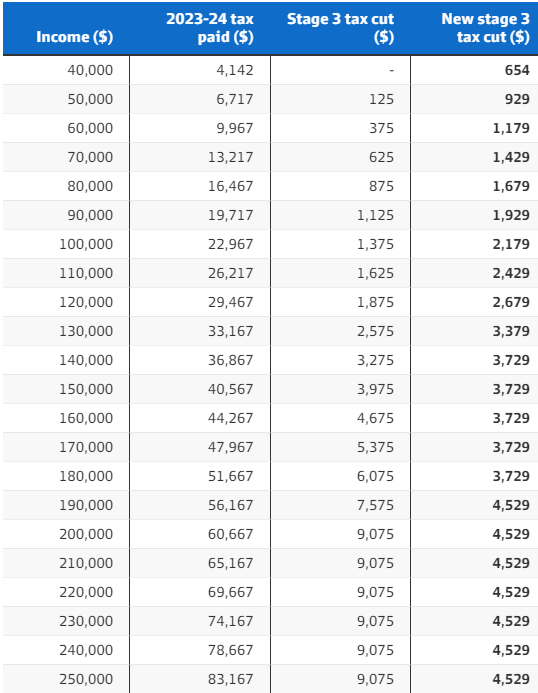

This is how you will be affected from the change of the original stage 3 tax cuts to the new proposition above:

Most taxpayers will gain from the new stage 3 tax cuts, particularly those who make between $45,000 and $135,000. But in contrast to the initial stage 3 plan, they will also reduce the benefit for the highest income earners. There would only have been two tax brackets above $45,000 under the previous plan: a 30% rate up to $200,000 and a 45% rate beyond that.

In order to make the stage 3 tax cuts more equitable and progressive and to free up funds for infrastructure and public services, the Labour government made the decision to change them. On January 24, 2024, Mr. Albanese made the announcement of the changes at the National Press Club. With the backing of the Greens and a few crossbench members, the changes are anticipated to pass through parliament.

If you want to see how much tax you will pay under the new stage 3 plan compared to the previous plan and the current system, you can use this calculator. The calculator also shows how much tax you would have paid under the original stage 3 tax cuts.

The new stage 3 tax cuts are part of the government’s response to the rising cost of living in Australia, which has been driven by high inflation and supply chain disruptions due to the COVID-19 pandemic. The government hopes that by giving more money back to taxpayers, it will boost consumer spending and economic growth.

It is important to note that as of writing, the new proposed Stage 3 tax cuts has yet to have it’s Bill passed, but it likely to move through uncontested.

If you have any questions or need further assistance, please contact us today. You can also browse our other blog posts for topics that may be of interest to you.

Recent Comments