Australian tax tables are tools that help you work out how much tax to withhold from payments you make to your employees or other payees. They are based on the tax rates and thresholds for Australian residents for different income years. There are different tax tables for weekly, fortnightly, monthly, and daily/casual workers.

These tax tables are important because they help you comply with your obligations as an employer or payer. They also help your employees or payees understand how much tax is deducted from their income and why. Sometimes, people may be confused when most of their overtime (OT) pay goes to tax.

This is because OT pay is added to your regular pay and taxed at a higher rate according to the tax tables. However, this does not mean that you will pay more tax overall. When you lodge your tax return at the end of the year, you may be entitled to a refund if you have paid more tax than their actual liability.

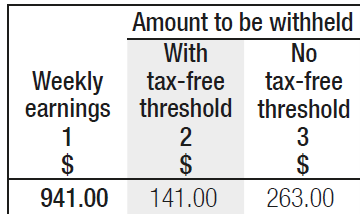

Weekly tax table: This table applies to payments made weekly, such as wages or salaries. It shows the amount of tax to withhold for each pay range, depending on the employee’s tax code and Medicare levy status. You can download the PDF version of this table from the Australian Taxation Office (ATO) website.

Weekly Example

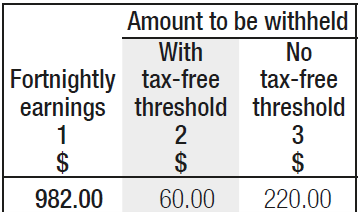

Fortnightly tax table: This table applies to payments made fortnightly, such as wages or salaries. It shows the amount of tax to withhold for each pay range, depending on the employee’s tax code and Medicare levy status. You can download the PDF version of this table from the ATO website.

Fortnightly Example

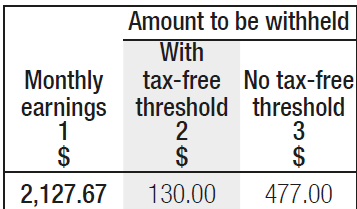

Monthly tax table: This table applies to payments made monthly, such as wages or salaries. It shows the amount of tax to withhold for each pay range, depending on the employee’s tax code and Medicare levy status. You can download the PDF version of this table from the ATO website.

Monthly Example

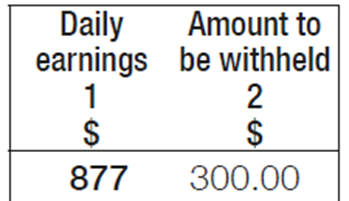

Daily/Casual workers tax table: This table applies to payments made to workers who are paid daily or casually, such as contractors or seasonal workers. It shows the amount of tax to withhold for each pay range, depending on the worker’s tax code and Medicare levy status. You can download the PDF version of this table from the ATO website.

Daily/Casual Example

If you have any questions or need further assistance, please contact us today. You can also browse our other blog posts for topics that may be of interest to you.

Recent Comments